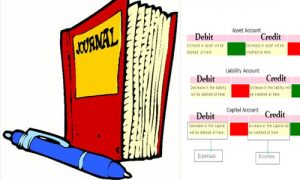

Accounts

A record of transactions including debit and credit entries throughout the fiscal year relating to a particular item or exacting person or concern.

For example, a firm has a Cash account in which every transaction involves cash. Each transaction involving cash will be entered and recorded in the cash account. If the company sells the software product for cash, the Cash account will be debited and the Sales account will be credited.

Real Accounts

Real accounts include all the assets of a company either tangible or intangible

Tangible Accounts

Tangible accounts are those who can touch or felt physically. For example building, vehicles, stock etc

Intangible Accounts

Intangible accounts include those accounts that have no physical existence and can’t be touched for example trademarks, goodwill, etc

Golden Rule for Real Accounts

| What Comes in | Debit |

| What goes out | Credit |

Example

Purchased machinery for $5000 in cash

| Machinery A/c | Debit | Assets what comes in |

| Cash A/c | Credit | Assets what goes out |

Personal Accounts

Personal Accounts consists of individuals, firms, companies, etc. A few examples of personal accounts include debtors, creditors, banks, outstanding/prepaid accounts, capital, drawings, etc.

Golden Rule for Personal Accounts

| The receiver | Debit |

| The giver | Credit |

Example

Paid to ERP.Gold $ 24,000 by check

| ERP.Gold A/c | Debit | The receiver |

| The Bank A/c | Credit | The giver |

Nominal Accounts

Nominal Accounts are related to expenses, losses, incomes or gains are called Nominal accounts. The nominal accounts have no physical form, but behind every nominal account, money is involved. E.g. Purchase A/C, Salary A/C, Sales A/C, Commission received A/C, etc.

The final result of all nominal accounts is either profit or loss which is then transferred to the capital account.

Golden Rule for Nominal Accounts

| All Expenses & loses | Debit |

| All income & Gains | Credit |

Example

Purchased good for $ 10,000 in cash

| Purchase A/c | Debit | All Expenses |

| Cash A/c | Credit | Assets what goes out |