Accounting documents is the game of numbers. Skills of an accountant are directly related to the success of the business. The slightest error in calculation can lead to a bigger loss. In business dealing accountancy is the part where the company proves it sincerity and legitimacy. Accountancy requires serious dedication and integrity.

For a smooth accounting operation, paperwork is necessary. Every single business needs paperwork. Though it is a nerve wrecking and hectic process but the paperwork is necessary through proper documentation.

This article will discuss the common accounting documents essential to a business.

Purchase Requisition with Accounting Documents

This document is used by the department who wants to notify for the items they want the purchasing department to buy for them. The details in this document include items required, their quantity, their description and the date of requisition. Purchase Requisition after approval leads to the Purchase Order.

Purchase Order

The purchase order is sent to the supplier to request the purchase of goods. This document can be designed into required format by the company. The basic information it includes ordered item, quantity, shipment address and total amount payable.

Invoice

Invoice is the record of money transactions for the sales and purchase. When a company purchases or sell the goods on cash an invoice is generated. It includes rate, quantity and the total amount of the goods. More than one copy of the invoice is generated and the main copy which purchaser receives becomes a bill.

Receipt

The receipt is the evidence of payment made on account of any business. It is prepared to show as a proof of payment received by those who receive the cash. Duplicate copies of receipt are also made.

The main copy is prepared to give it to them who make the payment and another copy is saved for the record by the payer. The details it includes is the amount of cash received, date name of the party who received and the type of payment.

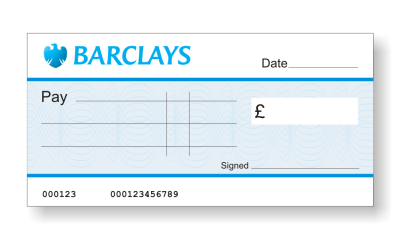

Cheque

Check is a bank document proving the disbursement of money from the company. It records the transactions reference to the payment made and attached necessary document like Sales invoice. Bank issues a booklet of the cheque to its account holder. It contains information of bank its branch, code, type of account.

A check should be duly approved by the authorized officer of the company. Payee affixes his signature on the cheque to confirm the payment received.

Debit Note

Debit Note shows that business has raised debit against a party. This note is sent to that part in respect of transaction other than sale’s credit. Company can make a debit note against the supplier for the amount to be recovered from him.

Debit note is also prepared in case of overpayment. It contains the details of the amount, date of the transaction and the details of the party whose account is debited. The reason of debiting is also mentioned.